Rarely does anyone look at their tax bill and think, “Yes! It’s just the right amount!”

But can you fight it? Maybe.

Your tax notice tells you how much you owe, but it also has a lot more information, like how your tax assessment was determined. Your assessment is comprised of two parts:

- Your tax rate. This rate is non-negotiable. It is the rate that is determined by the local governing bodies to support the local schools, municipalities, townships, park districts, libraries, etc. Other than the impact of your vote in elections for referendums and elected officials, you cannot change this number.

- The assessed value of your property. Now here’s where you can make sure everything is in order. You cannot determine the value of your property, but you can confirm that the assessed value makes sense. Also, this gives you an opportunity to make sure you’re receiving all the credits available to you, like homeowner’s exemption, senior exemption, disabled veteran’s exemption, etc. If the assessed value doesn’t seem right to you and if you have questions about not getting your proper exemptions, you can file an appeal and/or go to your township office with questions.

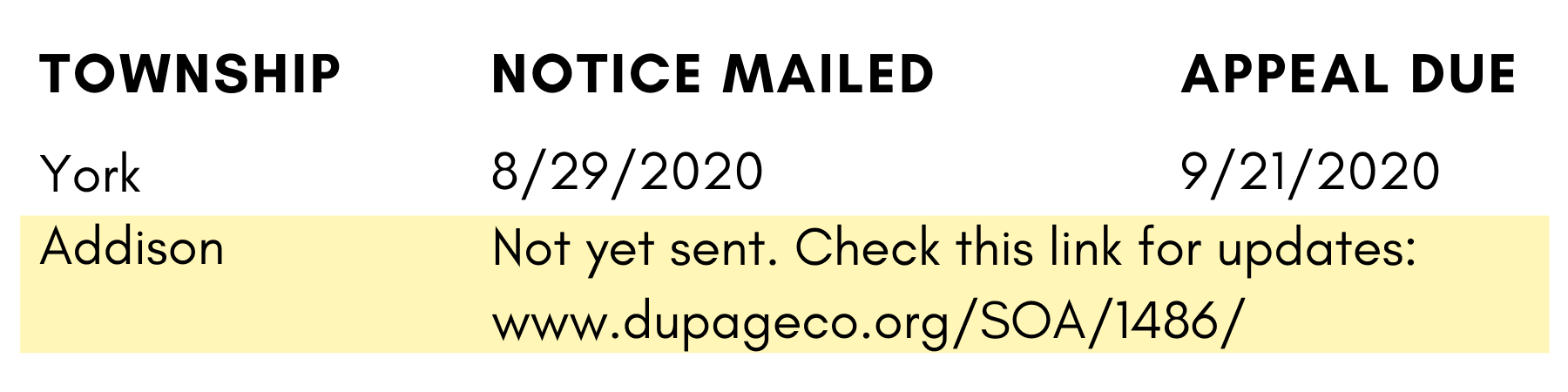

Due Dates

Check First

Before you begin an appeal process, make sure you have all your facts straight.

- Check to be sure the description of your property is accurate. Is the lot and building information correct? Is any information reflected on your tax bill inaccurate?

- Has anything changed with your property that has an impact on its value? Is that change reflected on your tax bill?

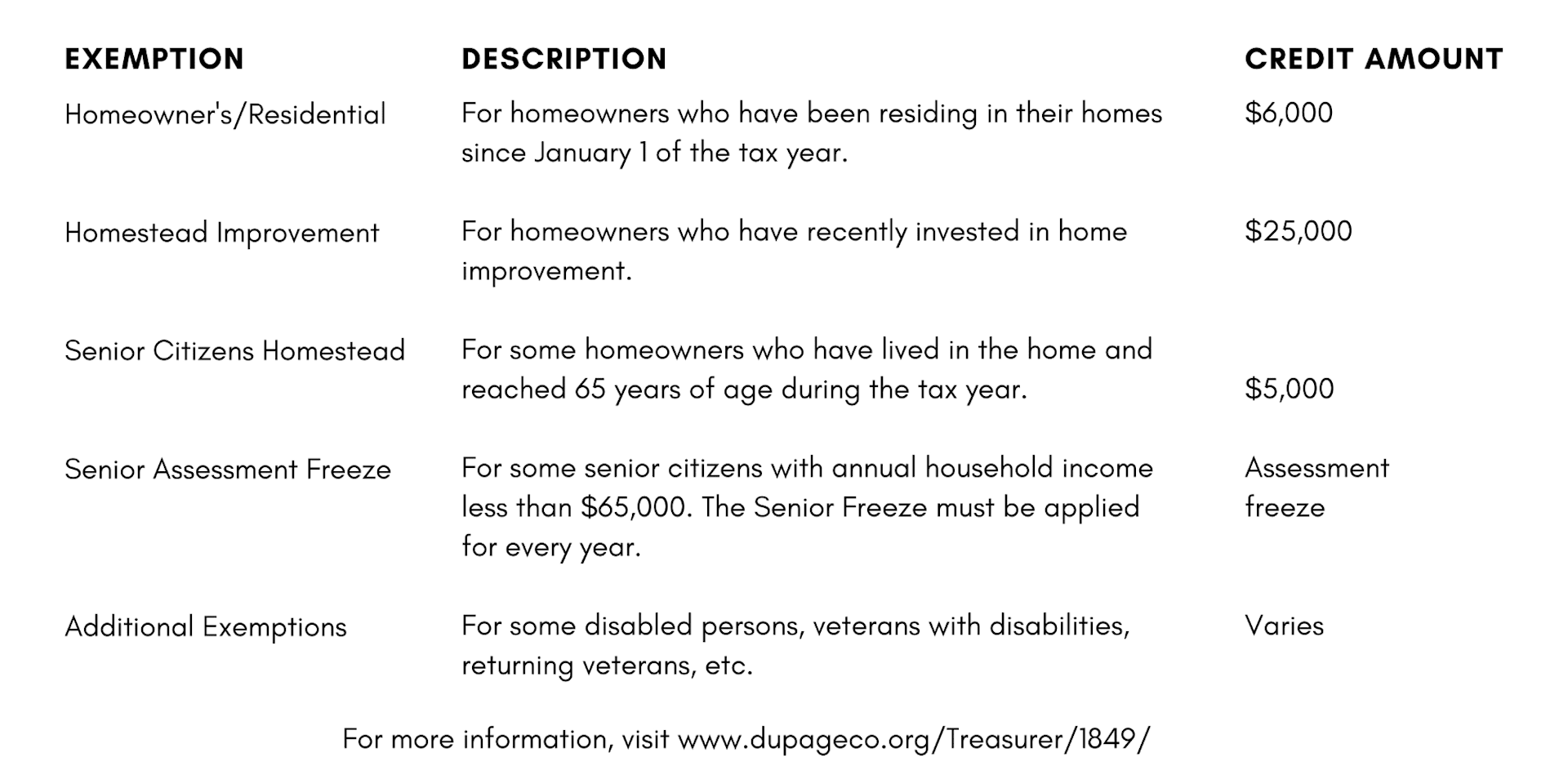

- Are you getting all the credits available to you? These are not credits toward your tax bill but rather credits that reduce the assessed value of your home. You will see these credits reflected on your tax bill.

Fair Market Value is the price the house would most likely be sold for, not the highest or lowest possible price.

Exemptions

Appeal-ability

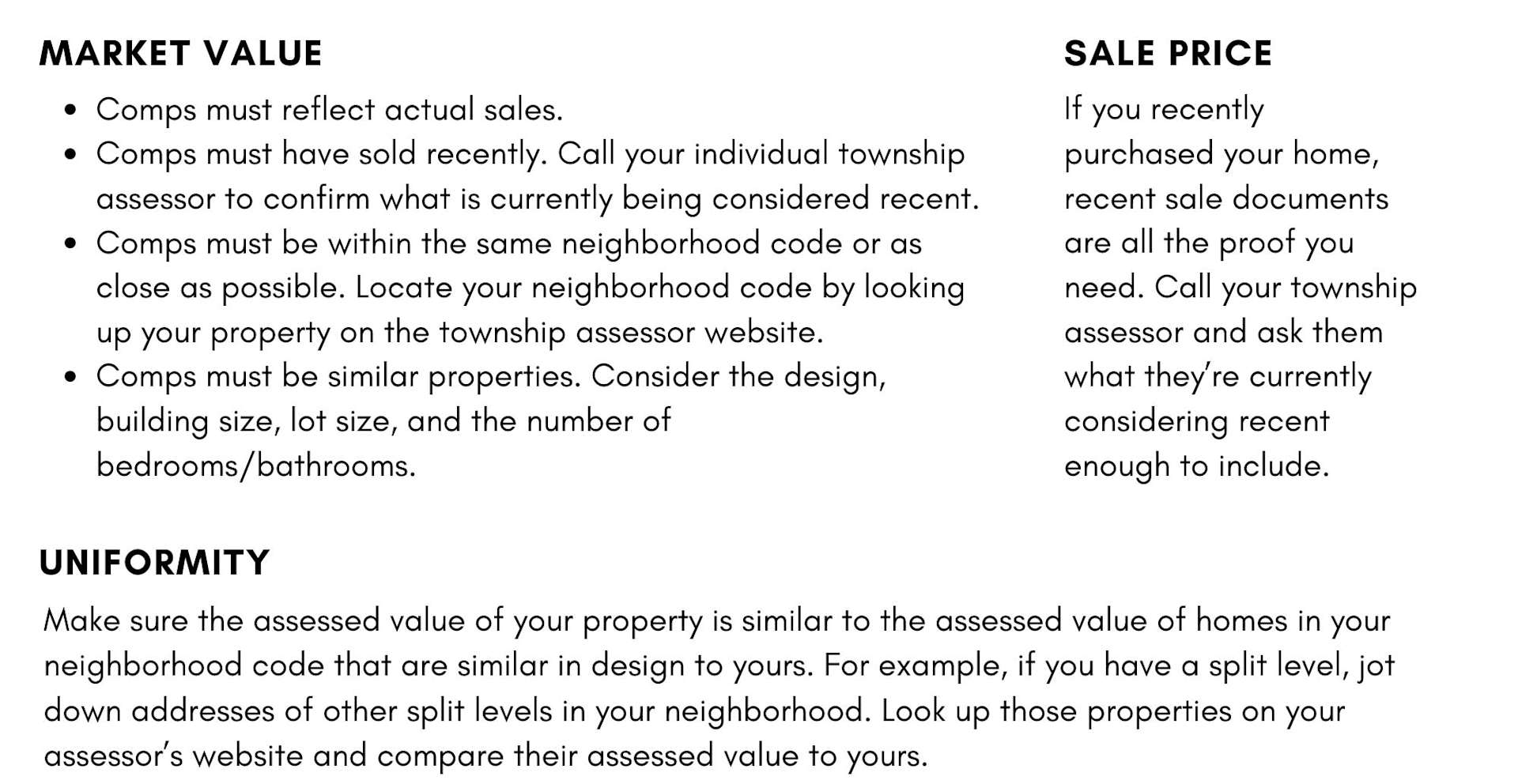

An appeal must provide proof that the valuation on your property tax bill overstates your property's assessed value in comparing uniformity to other similar neighborhood assessments or is higher than the recent sale prices of similar neighborhood properties.

Can you appeal? It’s actually pretty simple to determine. If you fall into one of three groups, you qualify for an appeal:

- You recently purchased your home or had your home appraised, and the assessed value on the tax bill is higher than the actual market value indicated by the sale or appraisal.

- The tax bill reflects inaccurate information about your property, like the description of your home or lot.

- The assessed values of similar neighborhood properties are lower than the assessed value of your property or if the sale prices of neighborhood homes reflect a lower assessed value.

If you don’t fit into any of those 3 categories, unfortunately, your tax bill is probably accurate.

If you need help understanding the process of finding comparable properties, contact your LW Reedy Real Estate agent. We’ll be happy to help.

Always check with your township office to confirm their policies and requirements.

Appeal Process

If you want to appeal, you may want to consider hiring an appeal expert to see if there is anything else you can do. Or you can try these steps:

- Call the township assessor's office (In Elmhurst, York Township or Addison Township)to review the information in their property files.

- File an appeal using the Board of Review Assessment Appeal Forms on the DuPage County Forms and Documents web page.

- Include at least three comparable properties, preferably within the same neighborhood. Include additional evidence of the value of your property. See the DuPage County Assessment Appeal webpage for details on comps or contact your LW Reedy Real Estate Agent for more information. Call your township to confirm the requirements.

- If you do not agree with the Board of Review’s decision after your appeal, you can appeal through the Illinois Property Tax Appeal Board or the Appellate/Circuit Court.

Residential Comparison Grid

If you have a recent certified professional appraisal to use as evidence, call your assessor’s office to set up an appointment to review it with them.

Real estate professionals’ comps are not accepted as an official appraisal. However, they are still useful in determining whether or not to move forward with an appeal. You can also use those comps to gather the proof you need: the property record cards for the comps. As a taxpayer, you have the right to inspect the property record cards, assessment records, real estate transfer declarations, and other evidence of the sale price of any property.

While you may not be able to lower your property tax bill, understanding how the assessment process works can at least help you feel confident that you’re paying the accurate amount. If you have any questions about your property tax bill or the appeal process, contact your LW Reedy Real Estate agent or our office. We are always happy to help you through the process or recommend a professional to take care of it for you.